Read our Employer Reference Number (ERN) explainer to learn all about what it is and how to find it.

Employer Reference Numbers, or ERNs, are usually associated with having employees, but you could need it even if you’re a contractor, freelancer or sole trader. Read on to find out what an ERN is, where you can find it in your documents and when you’ll be asked for it.

An Employer Reference Number (ERN) is given to every business that registers with HMRC and serves to identify you as an employer for employee income tax and National Insurance (NI) purposes. It’s a unique set of letters and numbers used by the Treasury to identify your company and is sometimes referred to as an ‘employer PAYE reference’ on tax forms.

This reference is made up of two parts: a three-digit HMRC office number, and a reference number unique to your business. It will be provided to you in your employer’s welcome pack when you register with HMRC, and will also appear on a range of correspondence from the taxman.

You’ll need your ERN in a few different circumstances – the most important of which will undoubtedly be when you come to complete your end of year PAYE return. An invalid or missing ERN is one of the most common (and easily avoidable) reasons for tax return rejection; you’ll need this number to hand to fulfil your reporting obligations.

You should also make sure you know your ERN if you have an employee. Employees often need their employer’s reference number when applying for tax credits and Student Loans, plus you might be required to include it on payslips, so the likelihood of them asking for it at some point is high.

Another time you’ll need your ERN within easy reach is when purchasing certain business insurances, most notably Employers’ Liability (EL). This is in order to identify and prove where an employee has worked in the event of a claim, particularly if the claim comes a significant time after the employee worked for you.

This is usually the case when it comes to health and safety claims – for example, those who worked with asbestos for years claiming after developing mesothelioma. The Employers’ Liability Trading Office has set up a database specifically for this reason.

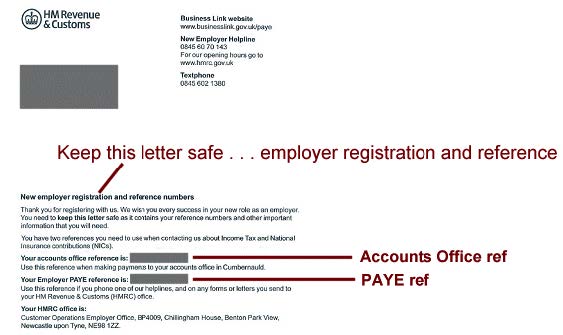

When you registered as an employer with HMRC you should’ve received a letter confirming your registration and supplying your new employer reference numbers. This is the best place to find your ERN.

If you don’t have this letter to hand, you can find your ERN on tax forms, payslips, P45 and P60 forms instead. It will usually be in the format: 123/A12345 and could also be referred to as an ‘Employer PAYE reference’.

If you don’t have any record of your ERN it may be that you are not registered as an employer. If this is the case, but you are employing or intend to employ someone, it’s of utmost importance that you register as a matter of urgency.

In some cases you may not have to register under PAYE and therefore won’t have an ERN. You don’t have you register for PAYE if: